Learn about Fort Worth Bonds including our News & Press Releases and Team.

Talk to us

Have questions? Reach out to us directly.

Learn about Fort Worth Bonds including our News & Press Releases and Team.

About Fort Worth, TX

- Population

- 955,900

- GO Bond Ratings

- Aa3/AA/AA/AA+

- Bonds Outstanding as of 7/20/23

- $2.585 billion

The City of Fort Worth is a political subdivision and municipal corporation of the State, duly organized and existing under the laws of the State, including the City’s Home Rule Charter. The City was incorporated in 1873, and first adopted its Home Rule Charter in 1924.

The City operates under a Council/Manager form of government with a City Council comprised of the Mayor and ten Councilmembers. The term of office for the Mayor and the ten Councilmembers is two years. The City Manager is the chief administrative officer for the City.

Some of the services that the City provides are public safety (police and fire protection), streets, water and sanitary sewer utilities, culture-recreation, public transportation, public improvements, planning and zoning, and general administrative services. The City covers approximately 359 square miles.

Image Gallery

News

Please click the below link to view all the news articles and press releases that are available on the City of Fort Worth’s government website.

In October 2023, City Council approved a 15% Stormwater utility fee increase for FY24, effective January 2024. Along with the Stormwater utility fee increases in FY20, FY24 and the recently approved FY25 increase, the Stormwater rate has increased seven times since the utility’s inception.

- These increases are significantly advancing the City’s efforts to keep its residents, homes and businesses safer from flood risks and reducing emergency response needs associated with flooding. Overall, however, known needs continue to exceed the program’s available resources.

What’s been accomplished so far for the capital improvement projects portion? This portion is funding the initial delivery phase for three large flood mitigation projects over a 15-year timeframe: Upper Lebow, Linwood/W. Seventh Street and the Berry/McCart area.

Over the last fiscal year, the program has advanced these projects in the following ways:

Upper Lebow

-

Began project development phase working on preliminary channel design, utility coordination and property acquisition.

-

Submitted two Federal Emergency Management Agency (FEMA) grant applications.

-

Submitted a state grant application to the Texas Water Development Board (TWDB) Flood Infrastructure Fund.

-

Began property acquisition needed to construct future improvements.

Linwood/West Seventh

-

Updated the existing drainage system model to better understand the current flood risk and allow for accurate evaluation and project development of flood mitigation alternatives.

-

Held meetings with the Tarrant Regional Water District (TRWD) to understand the impacts of potential outfall improvements to the Trinity River water levels and water quality regulations.

-

Evaluated potential detention and conveyance improvements to identify alternatives to advance into project development.

Berry/McCart

-

Began project development phase on future drainage improvements along Sandage Avenue.

-

Collaborated with Texas Christian University regarding potential partnership opportunities.

What’s been accomplished so far for the maintenance portion? As mentioned above, half of the FY24 Stormwater utility fee increase is going toward maintenance service level improvements. Implementation of a five-year plan for these improvements is underway.

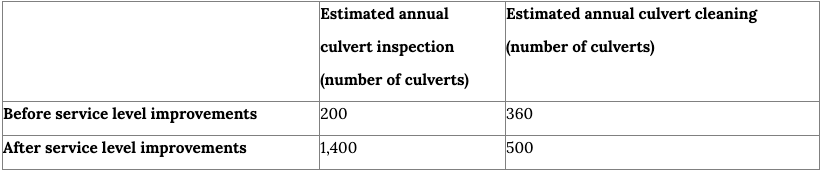

During FY24, Stormwater Field Operations kicked off a proactive citywide culvert inspection program to improve the prioritization of culvert cleaning needs. The City is responsible for approximately 4,000 culverts. This new program is the outcome of previously unidentified culvert maintenance concerns creating flood risks.

Five new staff were hired for this program in FY24 and as of December 2024, 666 culverts have now been inspected and 586 culverts have been cleaned, exceeding the City’s initial projections for the program’s first year.

The table below shows the estimated annual culvert inspection and cleaning capacity before and after the recent service level improvements.

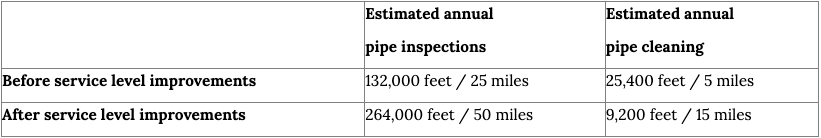

The second Stormwater maintenance program service level improvement in FY24 focused on the drainage pipe condition assessment program. A new seven-person team was created to inspect, clean and proactively plan ahead for drainage pipe condition assessments. This program accelerates the condition assessment process, enabling the City to more quickly identify and prioritize locations in need of rehabilitation, keeping the community safer from sinkholes. The work also accelerates the removal of trash and debris from the City’s drainage pipe system, which improves stormwater conveyance, mitigating the risk of flooding due to debris build-up in the storm drain system.

The table below shows the estimated annual pipe inspection and cleaning capacity before and after the recent service level improvements.

During FY24, in addition to the expanded service levels in the above two programs, Stormwater Field Operations:

- Maintained 5.8 miles of engineered channels through silt removal and re-establishing grade.

- Maintained 5.1 miles of bar ditches through regrading and silt removal to improve drainage.

- Restored 1.4 miles of engineered channels by rebuilding highly eroded channel slopes.

- Mowed 1,665 acres of right-of-way to ensure effective stormwater conveyance.

- Inspected and cleaned 6,691 of the total 30,000 inlets Citywide.

- Performed closed circuit television inspection (CCTV) condition assessment on 12.4 miles of drainage pipe to proactively identify and prioritize rehabilitation needs.

- Removed and replaced 1,807 square yards of damaged concrete storm drain infrastructure.

What’s the benefit to taxpayers? As a crucial step in safeguarding the community from future flood-related risks, the FY24 Stormwater fee increase funded multiyear phasing for three capital improvement projects, as well as enhanced service levels for maintenance of culverts and pipes. The funds from the increase were to be divided between capital flood mitigation projects and maintenance service level improvements.

Brief background: Fort Worth’s Stormwater utility launched in 2006 after five fatalities due to flooded roadways and significant flooding to 300 homes and businesses in 2004. The program’s mission: To protect people and property from harmful stormwater runoff.

To provide your feedback about the Stormwater program’s future priorities for funding and work efforts, please fill out the Stormwater Strategic Plan survey:

City councilmembers on Tuesday got an early look at a proposed 2026 bond program with congestion mitigation, economic development, leveraging funding opportunities and capital replacement initially becoming the focus.

On the table: City staff is considering a $800 million bond program, but requests for funding from departments far exceed that amount.

Fort Worth is on a four-year cycle for bond programs, with the most recent being approved by voters in 2022. Fort Worth continues its practice of developing the 2026 bond program with no property tax increase.

An early and evolving list of proposed projects for the 2026 bond program has been created by City staff for the purpose of gaining City Council input.

The list shows the bulk of bond funds going toward streets and mobility infrastructure improvements (59.6% of the $800 million total), followed by parks and open space improvements (23.1%). Other proposals include public safety improvements, primarily for the Fire Department and 911, 8%; animal shelter facility improvements, 7.5%; and public library improvements, 1.8%.

“In addition to this initial list of proposed projects that City staff has offered based on the available funding constraints, we know residents have interest in numerous other projects,” City Manager Jay Chapa said. “So besides the current recommended list, there is an additional menu of options that were just below the funding line that will be put forward for public comment. That list of projects totals $125 million.”

Staff-recommended projects

Streets and mobility funding

- Major roadways, $227.3 million, 10 projects.

- Neighborhood streets, $101.6 million, 15 projects.

- Intersection, $42.9 million, nine projects.

- Traffic signals, $25 million, 26 projects.

- Bridges, $25.8 million, four projects.

- Sidewalks, $19.2 million, nine projects.

- School safety, $8.3 million, six projects.

- Streetlights, $5.2 million, eight projects.

- Railroad crossings, $3 million, five projects.

- Vision Zero, a strategy to eliminate all traffic fatalities and severe injuries, $6.25 million.

- Active transportation, $8 million.

- Public art, $4.6 million.

Park and open space funding

- Community parks, $53 million, six projects.

- Community centers, $30 million to rebuild Atatiana Carr-Jefferson at Hillside Community Center.

- Fort Worth Botanic Garden, a contractual obligation, $10 million.

- Fort Worth Zoo, a contractual obligation, $4 million.

- Fort Worth Water Gardens, $10 million.

- Open space land acquisition, $25 million to be spent on land acquisitions and capital projects to prepare sites for public use.

- Aquatic facilities, $22 million, two new facilities: North Z Boaz and an aquatic and gym expansion of the YMCA.

- Golf courses, $5 million for the Meadowbrook Golf Course clubhouse and cart barn.

- Athletic complexes and infrastructure, $23 million, four projects.

- Public art, $3.1 million.

Library

$13.7 million for the expansion projects at Southwest Library, East Berry Library and Diamond Hill Library.

Public art: $300,000

Public safety

- Fire, $34.4 million to build a new Station 46 in far south Fort Worth near the Tarleton State University campus, and rebuild Station 40, originally built in 1983.

- 911 emergency communication, $28.3 million to renovate a City-owned building into a new 911 Call Center.

- Public art, $1.2 million.

Animal care

- $58.7 million for construction of a new 45,000-square-foot shelter to replace the current Silcox shelter in the southeast part of the city.

- Public art: $1.2 million.

What happens next?

Community engagement meetings will be held across the city starting this spring, and there will be online engagement tools available. Residents will be able to comment on the proposed projects as discussions progress.

This fall, City staff will finalize the project list based on public input. Final adjustments will be made to project costs, and the City Council will approve the list.

In January 2026, City Council will vote on calling the bond election. A public education meeting will be conducted in every council district ahead of the May 2026 bond election.

Team

Jay Chapa

Reggie Zeno

Credit Summaries

Talk to us

Have questions? Reach out to us directly.